Vertical SaaS Metrics - the complete handbook

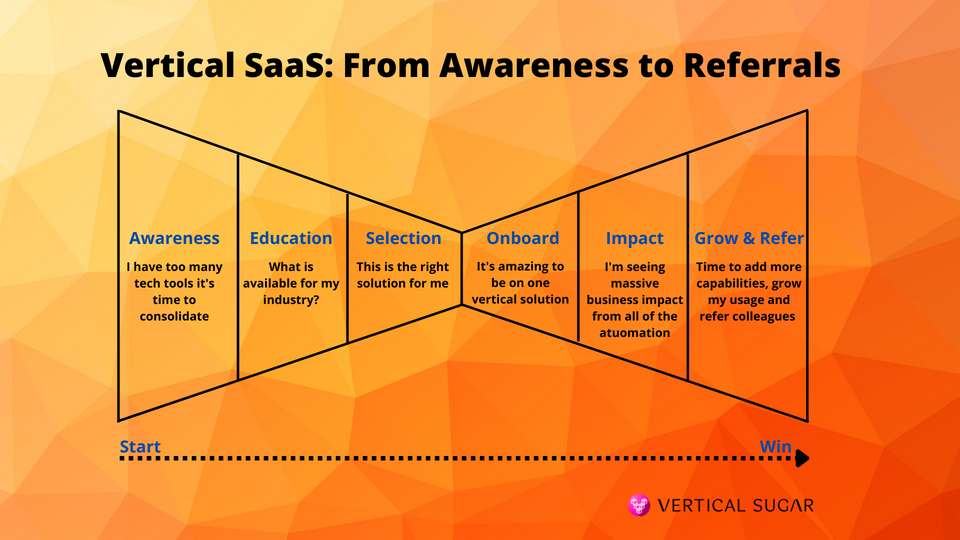

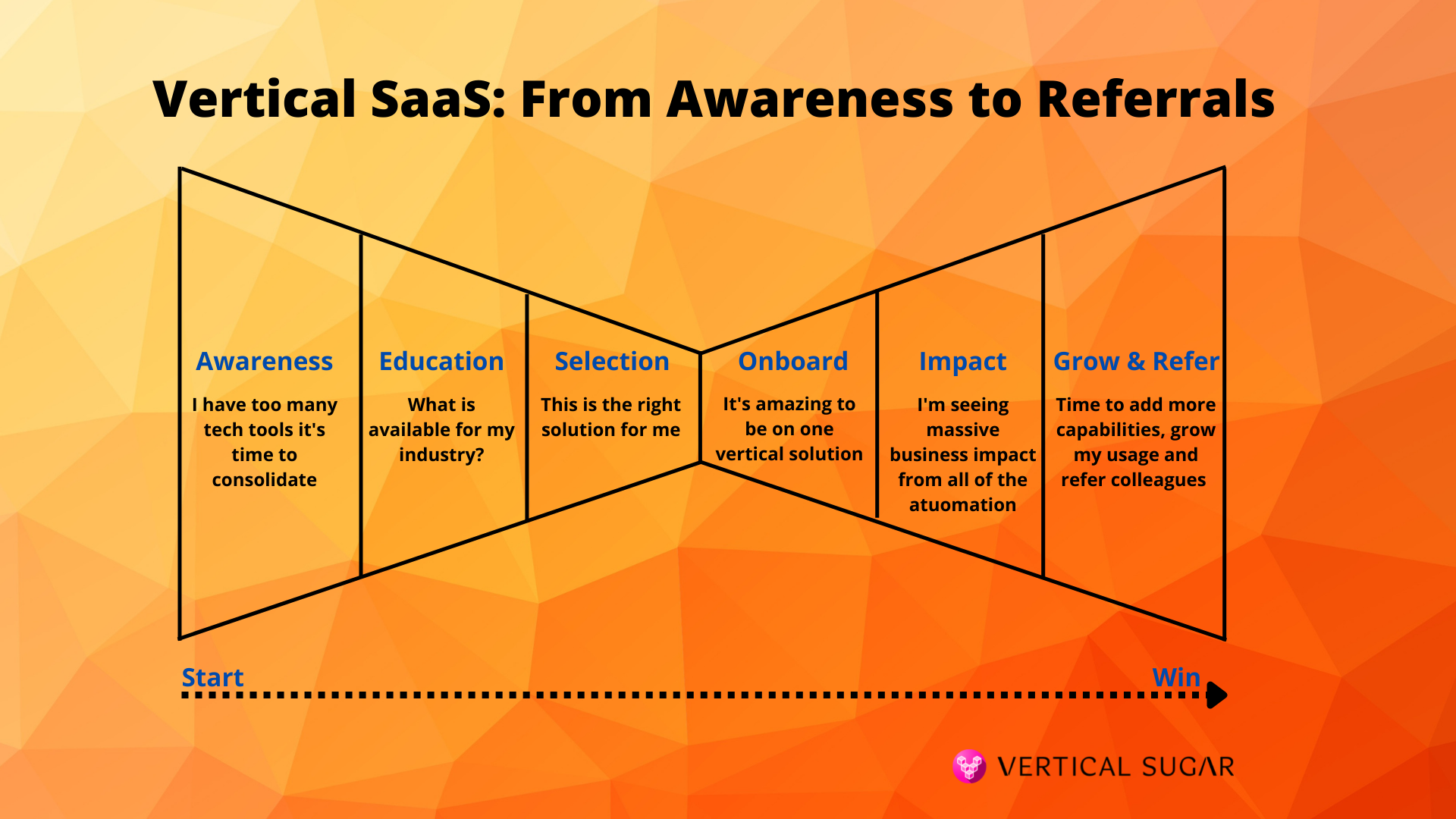

Vertical SaaS products have an amazing advantage, they are building a solution for a specific industry and customer. This will eventually lead to them winning SMB software. Knowing your customer allows for a true understanding of what matters to them: how to help grow their business, which features to build, which solutions to offer, and how best to sell. Understanding all of these requires both speaking with customers and closely observing metrics while running tests and making adjustments.

This is an evergreen handbook that we will update on an ongoing basis.

Context First

Before we dive into the specific metrics a bit of context about metrics and how to define them, use them and make them truly valuable.

To make metrics truly useful we need to understand them along three dimensions:

- Function: metrics that help you govern each function in the organization. These include Sales metrics, Marketing metrics, R&D metrics, Customer success Metrics, etc. Your goal here is to have enough coverage to quickly know if you are trending in the wrong direction to go in and fix it.

- Timeline & Funnel: Of the above metrics some are leading (they predict what will happen to the business in the future) some are lagging (i.e, they explain why something happened), and some are real-time. It's critical to understand which are which in order to provide a clear view of the business. For example "New first contacts by sales" is a leading sales metric, while the NPS score is at the same time a lagging indicator for sales (i.e. it tells us if we overpromised and underdelivered) and a leading indicator for customer retention (i.e. if NPS is trending downwards we can expect churn to go up).

- Qualitative & Quantitative: In addition to tracking Quantitative metrics understanding and leveraging Qualitative metrics is extremely important. Qualitative metrics are typically aggregates of free-text information. For example: if your companies receive 100 reviews a month the CEO and leadership team fully read the top 20 most viewed comments to understand the narrative. Additional examples could be reading employee's exit interviews, customer churn interviews, etc. Turning these into qualitative numbers many times vastly diminishes the value they hold, and they are a treasure.

Automation is Critical from Day 1 (almost)

For metrics to be helpful they need to be accurate and reported often. The only way to do so is through automation. We also like the push method (e.g. email, slack notifications, etc) much more than the pull option (dashboards) since when done well push helps create an incremental cultural shift.

In addition, to be useful metrics must be:

- Complete: Pulled from core data sets and displayed in a way that is both helpful and showcases data completeness. For example, if you are showing the average number of "New First sales contacts" each day it's very helpful to also show it by each salesperson and sorted. Doing so will immediately show you if there are salespeople that are not reporting any data. Just showing the average will hide the fact that some people are just not reporting the data, and will essentially "corrupt" the all-important average.

- Adopted: To make an impact metrics must be "adopted" i.e. understood and viewed often. One way to achieve this is by automatically sending them out on a consistent basis to all relevant people. Inside the note, it's critical to include not only the metrics themselves but also the definition of the metrics. Including the definition allows existing and especially new employees to learn exactly what these metrics mean and how they were created. It also helps build a deep understanding over time.

- Timely: Sharing the metrics consistently and frequently makes all the difference in the world. Depending on the metric and audience sharing should be done daily/weekly/monthly. Rarely should they be shared less frequently than monthly.

We will cover how to go about automating metrics in future posts.

Warning: Metrics used badly will harm your company

Metrics can be used badly or overused and harm organizations. Using the wrong metrics or placing too much emphasis on "good metrics" will cause bad behavior:

- Employees will change their behavior and focus too much on "rewarded" metrics rather than the overall health of the organization.

- Left unattended the employees that focus on these metrics in your organization will get rewarded and the "good actors", the people that care about overall success, will quit.

- More on this in another post, for the time being, use metrics carefully and in a balanced fashion and not as your sole measure of success and progress.

Now on to the actual metrics:

Metrics are a huge topic, we will add to more on an ongoing basis and focus on metrics that are key to Vertical SaaS Players.

We'll start with some of the most interesting & least used metrics

- Referrals - referrals are so massively important and often not tracked enough. They are $0 CAC and typically have a strong intent to buy so sales cycles are shorter. They are also the best metric of your client's happiness, even more than NPS. You can only succeed in the long run in Vertical SaaS with happy customers. In referrals we track the following:

- Total referrals - total referrals over time (monthly/quarterly/yearly)

- Average number of referrals per customer - Average number of referrals per customer over time (monthly/quarterly/yearly). Your customers know their colleagues, if they are happy with the product and service they will recommend you to others, you want to see this metric grow and expand over time. You also of course want to take actions to encourage and grow referrals, but starting with tracking is a must.

- Referrals by customer age - understanding when in their lifecycle customers refer you is very helpful to understand the customer's perceived value from your product. If most referrals happen in the first couple of months and then drop you know you are over-promising and under-delivering. If they only happen after a year, you know that onboarding is painful, but customers that get through it are happy.

- Referrals by "product/service" type - if you have multiple bundles or products test to see which ones generate the most referrals.

- Trendsetters: Outcome of referrals connected back to the referring customer to identify Trend-setters - track referrals that end in sales back to the referring customer, this helps you identify trendsetters and is very valuable when making pricing changes, launching new products, etc. These are the customers you want to connect with before launching major changes.

2. Partner sales - Partner sales are a very strong source of low CAC high-value customers, partners could be of different types: associations, freelancers, salespeople at existing clients, influencers, etc. If you don't have a partner sales program establish it, then track. More on partner sales in upcoming posts, once we share we will also update this section. Subscribe to be updated.

3. NPS - Net promoter score, simple question, good proxy, don't overuse it, but use it with every client quarterly. No response is bad. Follow up with all negative responders to understand core issues. More on this in future posts.

4. Customer support volume & resolution - Very basic but critical non the less, what's the volume of issues coming in, and how quickly are they resolved. When there is a spike in the number of issues do you know why and how to avoid them in the future.

5. Upsales and cross-sales to existing customers - happy customers buy more and churn less. Tracking carefully who buys what, when and in which sales method will allow you to productize sales and drive self-service upsales which is an incredible growth engine. Once built it can be used to sell both your product and partner products for additional revenue.

Now on to all the Metrics - Introducing the Vertical SaaS metrics DataBase

We are building an end-to-end Metrics database with the goal of covering every valuable Vertical Software metric, from definition to automation. Subscribe to be in the loop as we publish more. Below is a quick snap-shot of our work in progress.

What's next

This is only the beginning, we want to empower Vertical SaaS companies to be amazing. We're considering a consulting service for Vertical SaaS, specifically around operations and metrics, if you work at VSaaS company and would find it valuable please let us know at info@verticalsugar.com.

Until then, subscribe to stay in the loop: